We know agents want a quick quote to provide fast service to the insured. And we want to provide you one. We also want to give you a quality quote that includes all credits available, and we don’t want to give the insured any surprises when they are ready to bind.

The reason we ask “so many questions” up front is because in order to provide an accurate quote, the carrier needs a certain amount of information about the insured and their business. The more information you can provide on the initial application, the quicker an accurate quote can be given, and the closer the quoted price will be to the actual binding premium. Then your insured can get back to business and you can focus on your next client.

For trucking risks of 3 units or less you can use our one-page Commercial Auto – Quick Quote Questionnaire. It truly is quick!

If the insured has more than three units, follow along below for which info is needed just to quote the risk. When you’re ready to bind coverage, we’ll need all the information asked by application. The application described below can be found here: http://www.myronsteves.com/app/tr/Truck.pdf

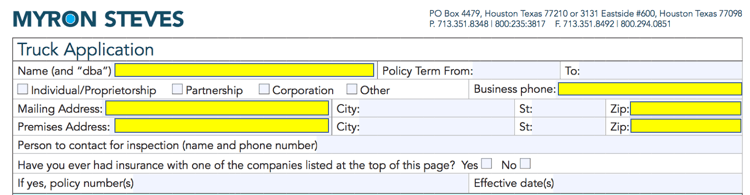

- Name and DBA

- Proper and complete named insured.

- Business Phone: Some carriers will want to do an inspection; they will use this phone number to set it up with the insured.

- Mailing Address and Premises Address: With zipcodes. Zipcodes are the most important part of the address because they help rate the risk in the correct territory. They also help us verify the business.

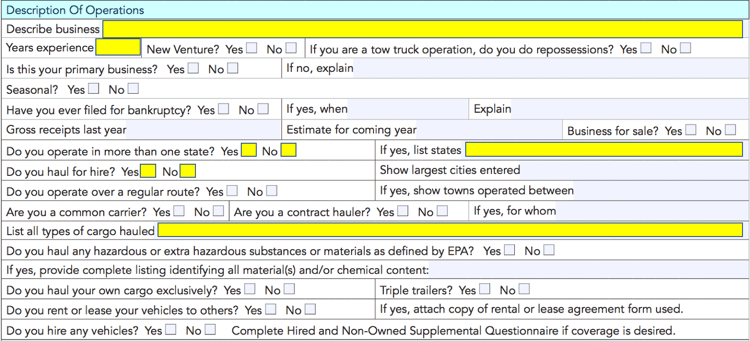

- Description of operations

- Describe Business: We need more than just “trucker.” List type of cargo (or commodities) hauled; how far do you haul?; radius of operation.

- Years Experience

- Operate in more than one state? We need to know every state of operation.

- Do you haul for hire? Or haul your owned cargo?

- Types of cargo hauled. Next to each cargo type, include the percentage breakdown of each cargo hauled.

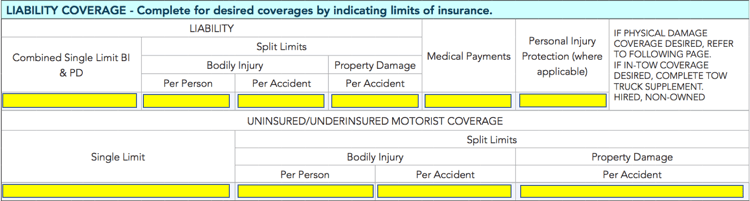

- Liability coverage

- We advise all agents to guide and advise their insured through this section. The insured must meet state guidelines, which the agent can provide; but the agent can recommend whether the insured should obtain higher limits based on the risk factors of the insured’s business. Gaining a thorough understanding of the business will help the agent provide the best advice.

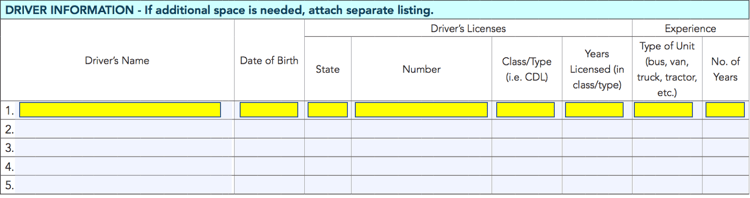

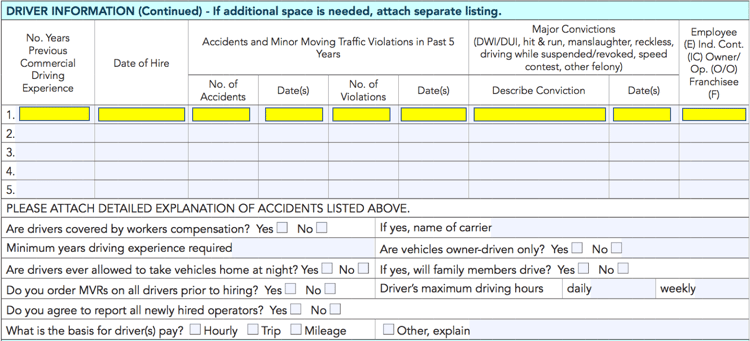

- Driver information

- Every column of the driver information section must be filled in for each driver employee. This information can provide credits and discounts, or uncover risky drivers that might be driving up the premium.

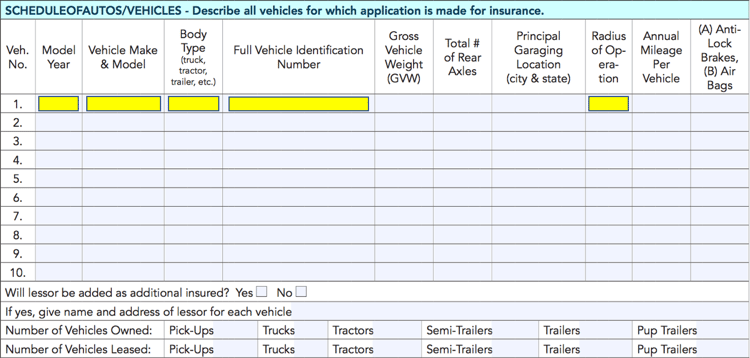

- Schedule of Autos/vehicles

- Include Year, Make/Model, Body Type, VIN of each owned by the business.

- Radius of Operation: Approximate radius of each vehicle is needed to accurately quote the risk.

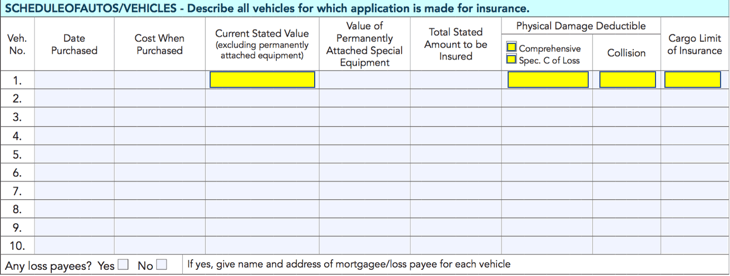

- Schedule of autos/vehicle (continued)

- Current Stated Value: This is need for each vehicle.

- Physical Damage Deductible: For each vehicle we need the desired deductibles. Choose either “Comprehensive” or “Specified Causes of Loss.”

- Cargo Limit of Insurance: Is cargo insurance needed? If so, list the desired limit per vehicle. Advise your client that the 100% co-insurance clause applies.

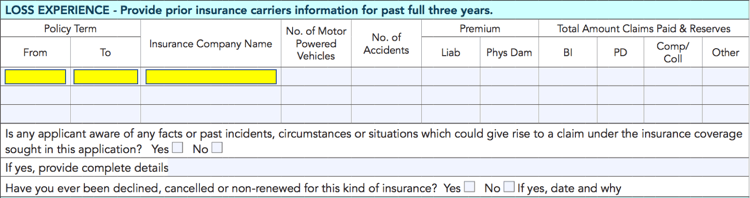

- Loss Experience

- Even if there were no losses, the insured must provide proof of insurance for the past full three years, unless this is a new venture. We do accept new ventures.

- Policy Term: Whether there is one prior carrier or multiple, the policy information provided must start with the current date, and date back three years.

- Insurance Company: Which carriers have the insured used for the past three years?

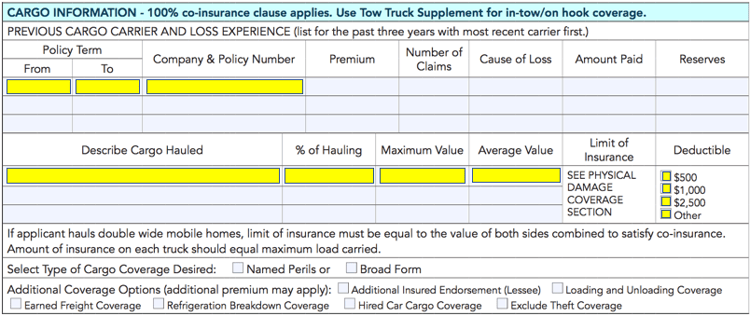

- Cargo Information

- Cargo insurance information is needed for the past three years, unless this is a new venture.

- Policy Term: Whether there is one prior carrier or multiple, the policy information provided must start with the current date, and date back three years. This could be the same as the liability coverage above or different.

- Insurance Company: Which carriers have the insured used for the past three years? This could be the same as the liability coverage above or different.

- Describe Cargo Hauled: List each type of cargo hauled; what percentage of time per commodity; maximum value per haul; and average value per haul.

- Deductible: What is the insured’s desired deductible?

- Named Perils or Broad Form? We typically quote Broad Form. If the insured prefers named perils, specify here.

- Additional Coverage Options: Review the additional options with your insured. Note, Loading and Unloading Coverage is typically covered under the broad form, but not under named perils.

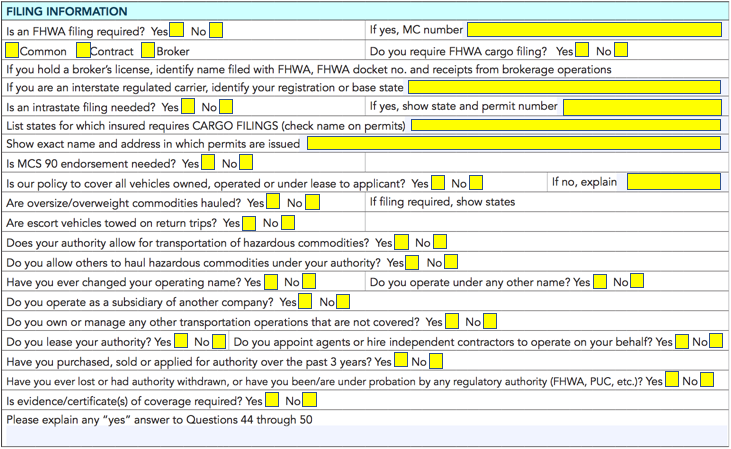

- Filing Information

- Is an FWHA filing required? If Yes, this section must be filled out completely.

- If no, disregard this section.

Myron Steves can help with any of your risks on wheels or garage risks. If you have any questions or want some help with this application, or any of our applications, give us a call or comment below.

To see a list of products and to access all applications, visit our Transportation website: http://www.myronsteves.com/Transportation.aspx